Apakah Anda seorang wanita dengan tubuh gemuk dan sedang mencari cara untuk terlihat lebih kurus? Salah satu solusinya adalah dengan memilih Model Rambut Pendek Wanita Gemuk yang tepat. Dalam panduan…

Model Rambut Pendek Cewek Gemuk

Pengenalan mengenai dunia model rambut telah menjadi bagian penting dalam dunia kecantikan. Menariknya, model rambut pendek untuk cewek gemuk kini semakin menjadi pilihan populer. Artikel ini akan membahas kelebihan model…

Potongan Rambut Pendek Wanita Tomboy

Potongan rambut pendek wanita tomboy telah menjadi tren yang tak terbantahkan. Wanita yang memilih gaya ini seringkali terlihat penuh kepercayaan diri dan berani. Namun, sebelum kita menyelami inspirasi potongan rambut…

Gaya Rambut Pendek Pria Sesuai Bentuk Wajah

Pernahkah Anda merasa bingung saat memilih gaya rambut pendek yang sesuai dengan bentuk wajah Anda? Tidak perlu khawatir lagi! Artikel ini akan memberikan panduan lengkap tentang gaya rambut pendek pria…

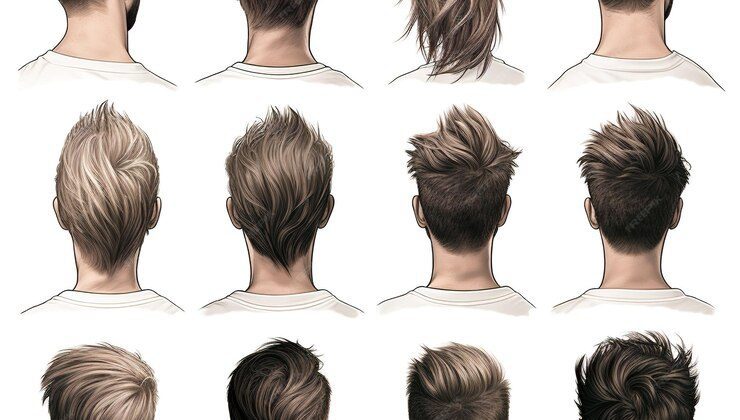

9 Gaya Rambut Pria Pendek Samping Belakang 2024

Selamat datang di dunia gaya rambut pria yang tak pernah surut! Apakah Anda mencari tampilan yang menarik dan maskulin? Gaya rambut pria pendek samping belakang bisa menjadi pilihan yang tepat.…

6 Minyak Pembawa untuk Kesehatan Rambut

Selamat datang di dunia perawatan rambut alami! Rambut yang sehat dan indah bukanlah impian yang tidak tercapai, dan salah satu kunci utamanya adalah menggunakan Minyak Pembawa (Carrier Oils) untuk Kesehatan…

Minyak Jarak Terbaik untuk Rambut: Pilihan 6 Produk Berkualitas

Minyak jarak telah menjadi bahan perawatan rambut yang populer, terutama karena kemampuannya merangsang pertumbuhan rambut dan memberikan kilau yang sehat. Dalam artikel ini, kita akan menjelajahi manfaat minyak jarak untuk…

5 Minyak Biji Anggur Terbaik untuk Rambut Berkilau dan Sehat

Rambut yang sehat dan bersinar selalu menjadi dambaan setiap orang. Tidak hanya tentang penampilan, tetapi juga tentang merawat kecantikan alami yang dimiliki setiap helai rambut. Dalam pencarian produk yang tepat,…

Memperbaiki Rambut Rusak Akibat Panas: Panduan Lengkap

Rambut yang sehat dan bersinar merupakan impian setiap orang. Sayangnya, seringkali penggunaan alat styling panas, seperti catokan dan hairdryer, dapat merusak struktur rambut. Dalam panduan ini, kita akan membahas cara…

8 Scrub Kulit Kepala Buatan Sendiri: Rahasia Rambut Sehat

Kesehatan rambut bukan hanya tentang penampilan, tetapi juga tentang kesejahteraan kulit kepala Anda. Salah satu cara terbaik untuk merawatnya adalah dengan menggunakan Scrub Kulit Kepala Buatan Sendiri. Scrub alami ini…